The Best Guide To Pvm Accounting

The Best Guide To Pvm Accounting

Blog Article

Indicators on Pvm Accounting You Should Know

Table of ContentsPvm Accounting Can Be Fun For EveryoneThe Basic Principles Of Pvm Accounting The 7-Second Trick For Pvm AccountingRumored Buzz on Pvm AccountingThe Only Guide to Pvm AccountingPvm Accounting for Beginners

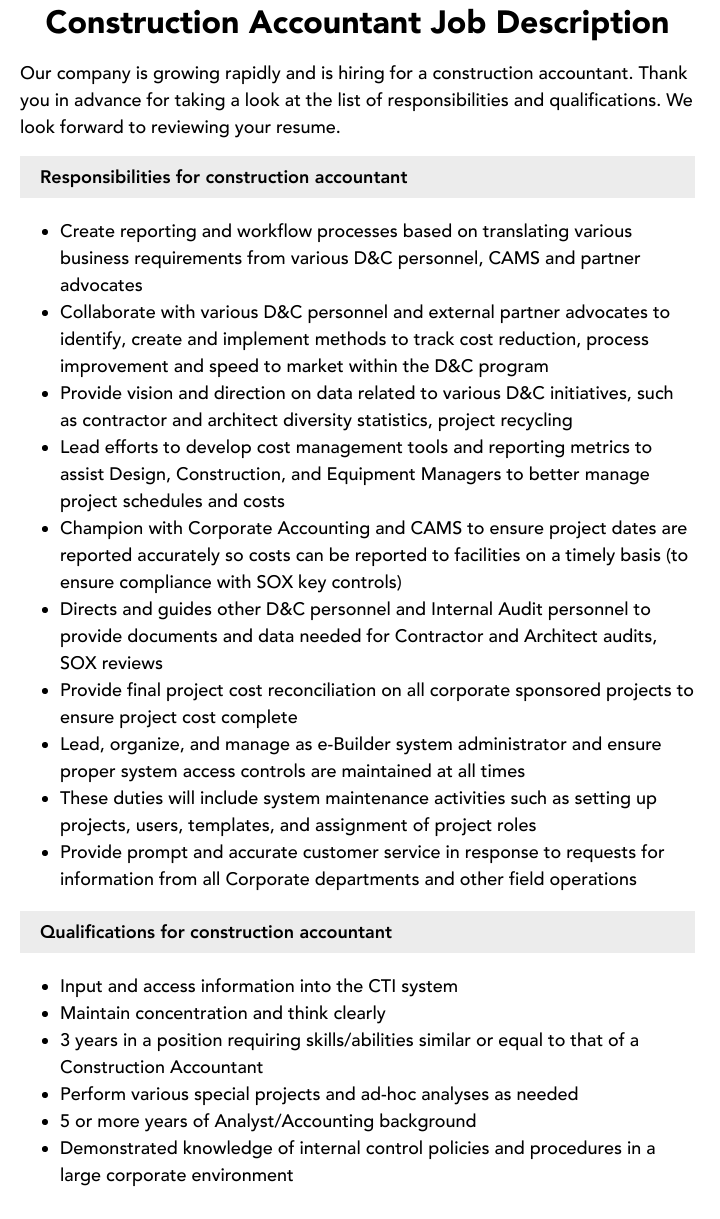

Guarantee that the accountancy procedure abides with the law. Apply needed building audit criteria and treatments to the recording and reporting of building activity.Connect with numerous financing firms (i.e. Title Company, Escrow Company) concerning the pay application process and requirements needed for repayment. Assist with executing and maintaining internal economic controls and treatments.

The above declarations are planned to explain the general nature and level of work being carried out by people assigned to this classification. They are not to be interpreted as an extensive list of obligations, obligations, and abilities called for. Workers might be required to perform duties beyond their regular duties every now and then, as needed.

7 Simple Techniques For Pvm Accounting

Accel is seeking a Building Accounting professional for the Chicago Office. The Building and construction Accountant executes a variety of accountancy, insurance compliance, and job administration.

Principal tasks consist of, but are not limited to, taking care of all accounting features of the firm in a timely and accurate way and providing reports and routines to the business's certified public accountant Company in the preparation of all financial statements. Makes certain that all accounting treatments and features are managed accurately. In charge of all monetary documents, pay-roll, banking and daily operation of the accounting feature.

Works with Job Managers to prepare and upload all regular monthly billings. Generates monthly Work Expense to Date records and functioning with PMs to integrate with Job Managers' spending plans for each job.

The 8-Second Trick For Pvm Accounting

Effectiveness in Sage 300 Building And Construction and Realty (previously Sage Timberline Workplace) and Procore construction monitoring software program a plus. https://fliphtml5.com/homepage/dhemu/leonelcenteno/. Should additionally excel in various other computer software program systems for the preparation of records, spread sheets and various other audit analysis that might be called for by administration. Clean-up accounting. Should have solid organizational skills and capability to focus on

They are the financial custodians who make certain that construction jobs stay on budget plan, adhere to tax policies, and keep financial transparency. Building accounting professionals are not just number crunchers; they are calculated companions in the construction process. Their primary function is to handle the economic facets of construction projects, guaranteeing that resources are alloted effectively and economic risks are lessened.

Pvm Accounting for Dummies

They work carefully with job managers to produce and monitor spending plans, track expenditures, and forecast financial demands. By preserving a tight grasp on task financial resources, accountants assist stop overspending and monetary problems. Budgeting is a keystone of effective building and construction jobs, and construction accountants are important in this regard. They produce comprehensive spending plans that incorporate all task costs, from products and labor to permits and insurance.

Building and construction accounting professionals are skilled in these guidelines and make certain that the project conforms with all tax demands. To succeed in the duty of a construction accountant, individuals need a solid academic structure in audit and money.

Additionally, certifications such as Certified Public Accounting Professional (CPA) or Certified Construction Sector Financial Specialist (CCIFP) are highly regarded in the sector. Building projects frequently involve tight deadlines, transforming guidelines, and unexpected expenditures.

What Does Pvm Accounting Mean?

Ans: Construction accountants create and check budget plans, identifying cost-saving possibilities and guaranteeing that the job stays within budget. Ans: Yes, building and construction accountants take care of tax conformity for building and construction projects.

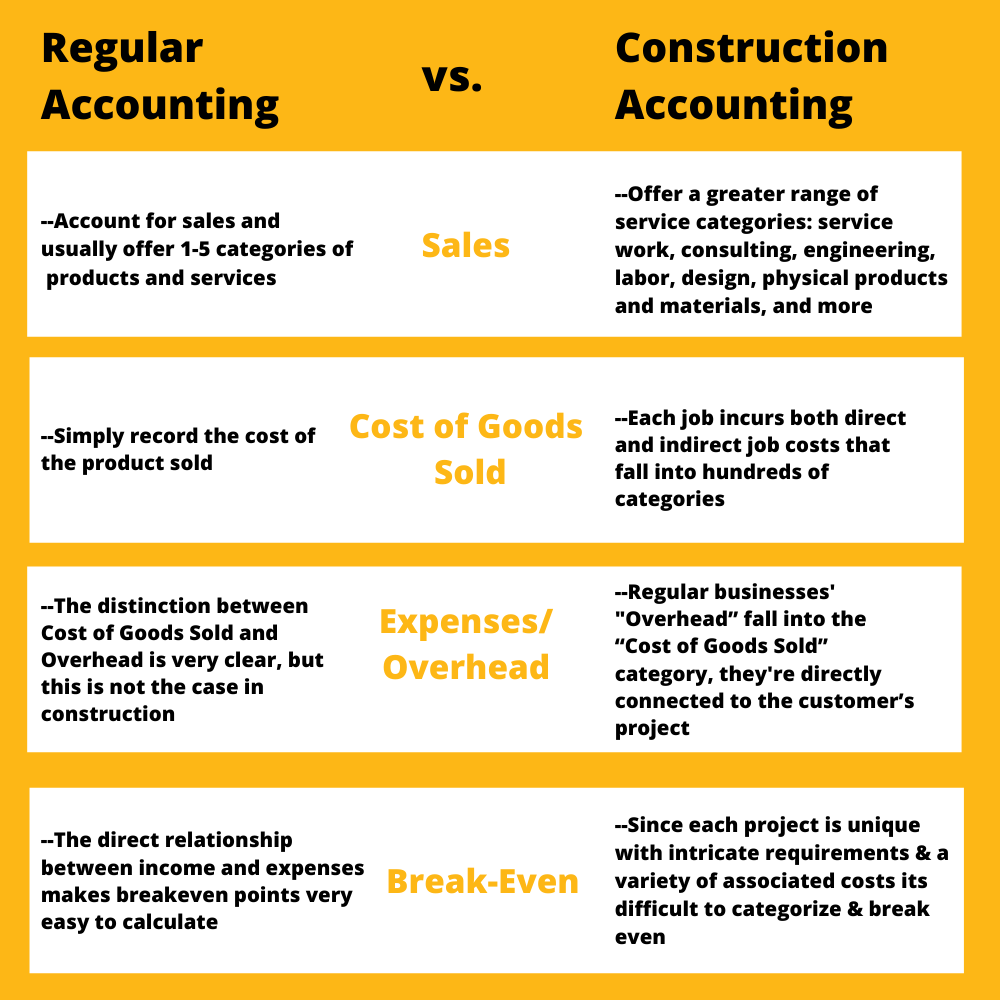

Intro to Construction Audit By Brittney Abell and Daniel Gray Last Updated Mar 22, 2024 Construction business need to make challenging selections among several financial alternatives, like bidding process on one job over an additional, selecting financing for products or tools, or setting a job's profit margin. On top of that, building and construction is a notoriously volatile sector with a high failure rate, slow-moving time to payment, and inconsistent capital.

Production involves duplicated procedures with easily recognizable costs. Production calls for different procedures, products, and equipment with differing prices. Each project takes area in a brand-new area with varying website conditions and special obstacles.

The 10-Second Trick For Pvm Accounting

Lasting connections with suppliers alleviate arrangements and improve efficiency. Irregular. Constant usage of various specialized contractors and providers impacts effectiveness and capital. No retainage. Repayment gets here completely or with normal settlements for the complete agreement amount. Retainage. Some portion of payment may be withheld till task conclusion even when the specialist's job is finished.

While standard producers helpful site have the benefit of controlled atmospheres and enhanced manufacturing procedures, building business must frequently adapt to each brand-new task. Even rather repeatable projects call for modifications due to site problems and various other elements.

Report this page